Decoding Transportation Multiples: How Infrastructure Rewrites Land Value

Part of the Infrastructure Thesis

When an investor asks me "How much will this land appreciate?", I don't give them a percentage. I ask them, "what is its future connectivity?"

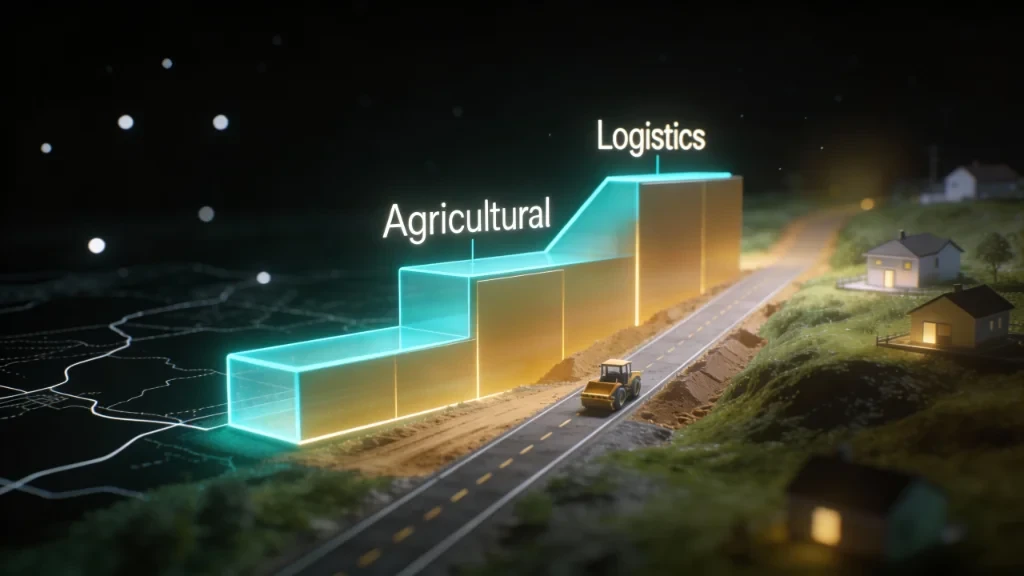

Real estate appreciation isn't linear; it's step-function. And the steps are defined by one thing: Access.

The Three Multiples of Land

In the lifecycle of a high-growth corridor (like the Yamuna Expressway or the Dholera SIR), land transitions through three distinct pricing multiples.

1. The Agricultural Multiple (1x)

This is raw earth. It measures yield in crops per acre. It's cheap, but it's illiquid.

- Driver: Soil quality, rainfall.

- Buyer Profile: Farmers, local aggregators.

2. The Connectivity Multiple (3x - 5x)

This happens when a highway announcement turns into a tender. Suddenly, the land isn't just soil; it's accessible.

- Driver: road access, travel time reduction.

- Buyer Profile: Speculators, early-stage investors.

3. The Logistics/Industrial Multiple (10x - 20x)

This is the "Golden Event." An interchange opens. A cargo airport gets approved. The land is no longer just "reachable"—it is now a node in a supply chain.

- Driver: 20 min access to cargo hubs, zoning changes (Ag to Industrial).

- Buyer Profile: Warehousing giants, factories, MNCS.

The Alpha Strategy: You buy at the late Agricultural stage (just before tender), hold through the Connectivity phase, and exit at the early Logistics phase.

The Evidence: Yamuna Expressway

Look at the data from the Yamuna Expressway (YEIDA) region.

- 2009: Land prices were ~₹500/sqm (Ag Multiple).

- 2012: Expressway opens. Prices hit ~₹2,500/sqm (Connectivity Multiple).

- 2024: Jewar Airport tests flights. Prices hit ~₹25,000+/sqm (Logistics Multiple).

That is a 50x jump, driven not by "market sentiment," but by the verifiable utility of the land changing from farming to flying.

Case Study 2: The Revas-Redi Coastal Highway (MSH-4)

While Yamuna Expressway is a logistics corridor, the MSH-4 in Sindhudurg is a "Lifestyle Corridor." The ongoing 4-laning has turned remote villages like Vengurla into 50-minute suburbs of Mopa Airport. This is why prices in Kondura are moving from the connectivity multiple (3x) toward a lifestyle premium.

Determining the "Golden Zone"

Not all land near a highway wins. You need the Golden Zone.

- Rule 1: 2-5 km from an Interchange. (Too close = noise/pollution. Too far = no logistics utility).

- Rule 2: Wide frontage road access (minimum 12m road).

- Rule 3: Clear titles (avoid legal disputes common in acquisition zones).

Executing This Strategy

Identifying the multiple is the easy part. The hard part is execution—title checks, negotiation with farmers, and securing boundaries.

If you are an NRI investor, these logistics can be daunting. You need a vetted partner to handle the "ground game" while you hold the asset.

Read: How NRIs Can Executing Land Deals Safely

Conclusion

Don't buy land. Buy the probability of a multiple change. If you can't see the path from Agricultural to Logistics, you are just speculating. If you can map the infrastructure timeline, you are investing.

Kanav Arora

Real Estate Investor

Read Next

Dehradun 2.0: The 3 Growth Corridors defining the next decade (2026-2036)

The 'Rajpur Road Premium' is dead. Smart capital in Dehradun is moving to three specific corridors defined by infrastructure: The Ropeway, The Cyber City, and The Water-Secure Zone.

Mopa Aerocity: The 'Aerotropolis' Shift that is Redrawing the Goa Map (2026)

The center of gravity in Goa has shifted 30km North. We analyze the 'Aerotropolis' effect, the border arbitrage opportunity in Sasoli, and why the 'Path of Progress' points to Sindhudurg.

High-Growth Land Investing in India: The Infrastructure Thesis

Why smart money chases infrastructure, not hype. A deep dive into 'Transportation Multiples', early-cycle land acquisition, and the Dholera opportunity.