High-Growth Land Investing in India: The Infrastructure Thesis

In real estate, value isn't created; it's transferred by connectivity.

Most investors chase established markets—places where the headlines have already been written and the premiums already paid. They buy into "safe" appreciation, often settling for 4-6% yields that barely beat inflation.

But the real wealth in Indian real estate isn't found in the saturated centers of Mumbai or Delhi. It's found in the corridors connecting them. It's found where the map is being redrawn.

This is the Infrastructure Thesis: the conviction that massive government CAPEX on expressways, airports, and industrial corridors is the single reliable predictor of explosive land value appreciation.

The Concept of 'Transportation Multiples'

I use a simple mental model called "Transportation Multiples."

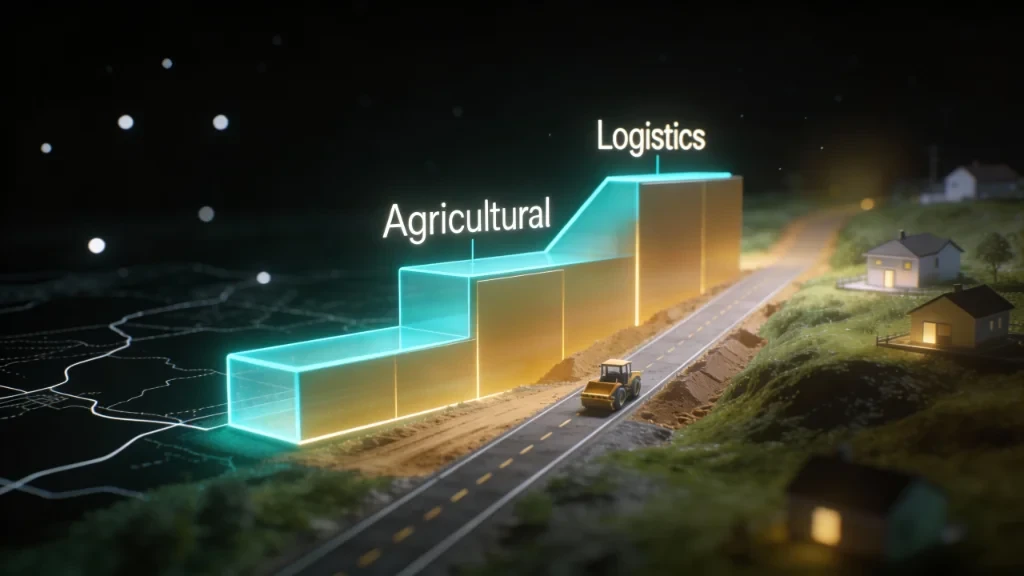

When a plot of land is just dirt, it trades at an agricultural multiple. Add a road, and it trades at a connectivity multiple. Add an expressway interchange or a cargo airport within 20km, and it trades at a logistics multiple.

The game isn't to buy land. The game is to buy future logistics capacity at today's agricultural prices.

"I don’t chase hype—I chase infrastructure timelines, then buy before the crowd notices."

Why This Cycle is Different

India is currently undergoing the largest infrastructure build-out in its democratic history. The Bharatmala Pariyojana, the Dedicated Freight Corridors (DFC), and the Delhi-Mumbai Industrial Corridor (DMIC) aren't just road projects. They are economic arteries.

Historically, cities grew organically. Today, they are being engineered. Special Investment Regions (SIRs) like Dholera are not suburbs; they are purpose-built global manufacturing hubs designed to rival Shenzhen.

Key Drivers of Value Migration

- Reduced Logistics Cost: India aims to lower logistics costs from 14% to 8% of GDP. Land parcels that facilitate this (warehousing hubs, industrial belts) will command premium pricing.

- Tier-2 Urbanization: As metros saturate, growth is spilling into satellite cities connected by high-speed rail and expressways.

- Policy Support: RERA and digitised land records have removed the "black box" risk from land investing, making it accessible to methodical investors.

Live Corridors to Watch (2026)

We are currently tracking three "high-alpha" zones where this thesis is playing out in real-time:

- Dholera SIR: The semiconductor capital of India. Read our Deep Dive Opportunity Analysis.

- Delhi-Dehradun Expressway: A tourism and lifestyle corridor cutting travel time to 2.5 hours. Read the full Expressway Report.

- Saharanpur: The logistics hub emerging at the crossroads of EDFC and DDE. Read the Investment Case.

Evaluating the Opportunity: The Checklist

Before I deploy capital, I look for three non-negotiable signals:

- The Government Commitment: Is the project funded? Are tenders awarded? (Avoid mere announcements).

- The Connectivity Node: Is the land within the "Golden Zone" (2-5km from an exit, but not right on the highway)?

- The Anchor Tenant: Is a major industry or PSU setting up shop nearby? (e.g., Tata Electronics, Micron).

A Note for NRI Investors

If you are an NRI looking at this landscape, the opportunity is massive, but the execution requires navigation. You face unique regulations under FEMA and specific tax implications.

I have written a dedicated guide tailored to your regulatory environment. If you are investing from abroad, read this first:

Read: Indian Real Estate for NRIs – A Global Investor's Guide

It covers the "How" of executing this thesis while staying compliant with Indian laws.

Conclusion

The window to acquire early-cycle land in India's emerging corridors is narrowing. As these projects move from "planned" to "operational," the multiples will compress.

The Infrastructure Thesis is not about speculation. It is about positioning. It is about understanding that in a growing economy, all roads lead to wealth—if you own the land next to them.

Kanav Arora

Real Estate Investor

Read Next

Dholera SIR: India's First Smart City or a Real Estate Mirage?

Why the Tata Electronics plant changed everything for Dholera land investors.

Decoding Transportation Multiples: How Infrastructure Rewrites Land Value

Understand the math behind 10x returns. Agricultural to Logistics multiples explained.

The Village Land Play: Why Dholera's Periphery Might Outperform the Core

While everyone fights for expensive TP plots, smart money is buying agricultural land in the spillover zone. Here is the math behind the 'Jewar Effect'.