Finance•2 min read•

NRE vs NRO Account: Which One for Property Purchase?

Kanav Arora

Real Estate Investor

The Direct Answer

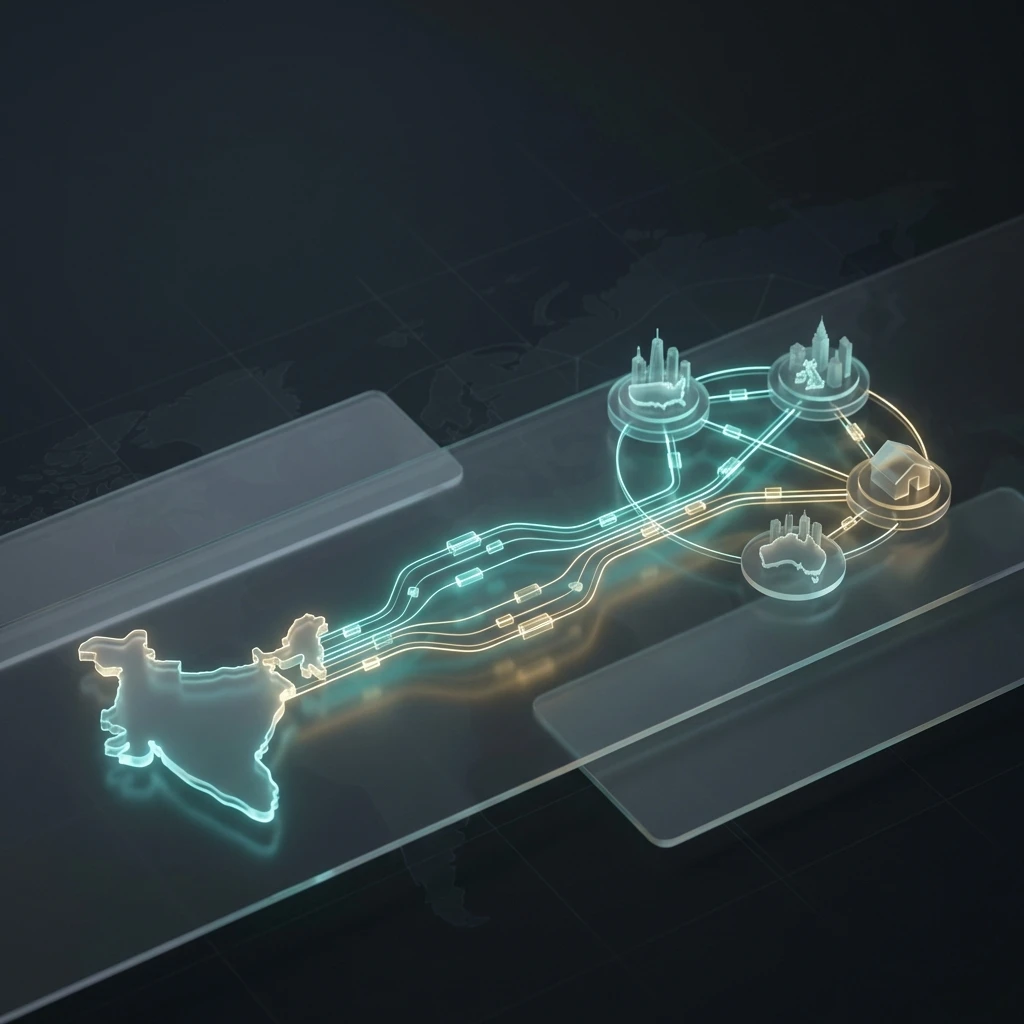

NRE (Non-Resident External) = Money you earned abroad. It is fully repatraible. Use this to BUY property. NRO (Non-Resident Ordinary) = Money earned in India (Rent, Dividends, Sale Proceeds). Use this to RECEIVE funds (Rent/Sale).

✈️

The Golden Rule

Always Buy via NRE; Always Receive via NRO. If you pay for a property using an NRE cheque, the RBI allows easy repatriation of the principal amount later. If you pay via NRO (Indian earnings), repatriation requires more paperwork (15CA/15CB).

Comparison Table

| Feature | NRE Account | NRO Account |

|---|---|---|

| Source of Funds | Foreign Income (USD/GBP/AED) | Indian Income (Rent/Sale Proceeds) |

| Repatriability | Freely Repatriable (No limits) | Restricted ($1M USD / year) |

| Tax on Interest | Tax-Free in India | Taxable at ~30% |

| Joint Account | With another NRI only | With Resident Indian (Former or Survivor) |

| Best Use | Parking Savings / Buying Home | Collecting Rent / Paying Bills |

Common Scenarios

- Buying a Flat: Transfer Dollars -> NRE Savings -> Write Cheque to Builder.

- Collecting Rent: Tenant transfers INR -> NRO Savings.

- Selling a Flat: Buyer pays INR -> NRO Savings -> You repatriate to Foreign Account.

- Paying Home Loan: Can pay from NRE or NRO (but preferable to pay from NRE to keep Repatriability intact).

Can I transfer money between them?

- NRE -> NRO: ✅ Yes, Allowed freely.

- NRO -> NRE: ❌ Restricted. Requires 15CA/15CB certificates (proof of tax payment).

Kanav Arora

Real Estate Investor

Read Next

Finance•2 min read

Repatriating Property Sale Proceeds: The NRI Guide to Getting Money Out