Repatriating Property Sale Proceeds: The NRI Guide to Getting Money Out

The Direct Answer

NRIs can repatriate (move out of India) up to USD 1 Million per financial year (April to March) from their NRO account balances. This includes proceeds from the sale of property. You must pay the applicable capital gains tax first. The key documents are Form 15CA (Client's Undertaking) and Form 15CB (Chartered Accountant's Certificate) to prove taxes are paid.

The 'Inheritance' Loophole

If you inherited the property, you can still repatriate the sale proceeds. You just need to prove the inheritance trail (Will + Probate or Succession Certificate) and pay tax on the capital gains calculated from the original owner's acquisition cost.

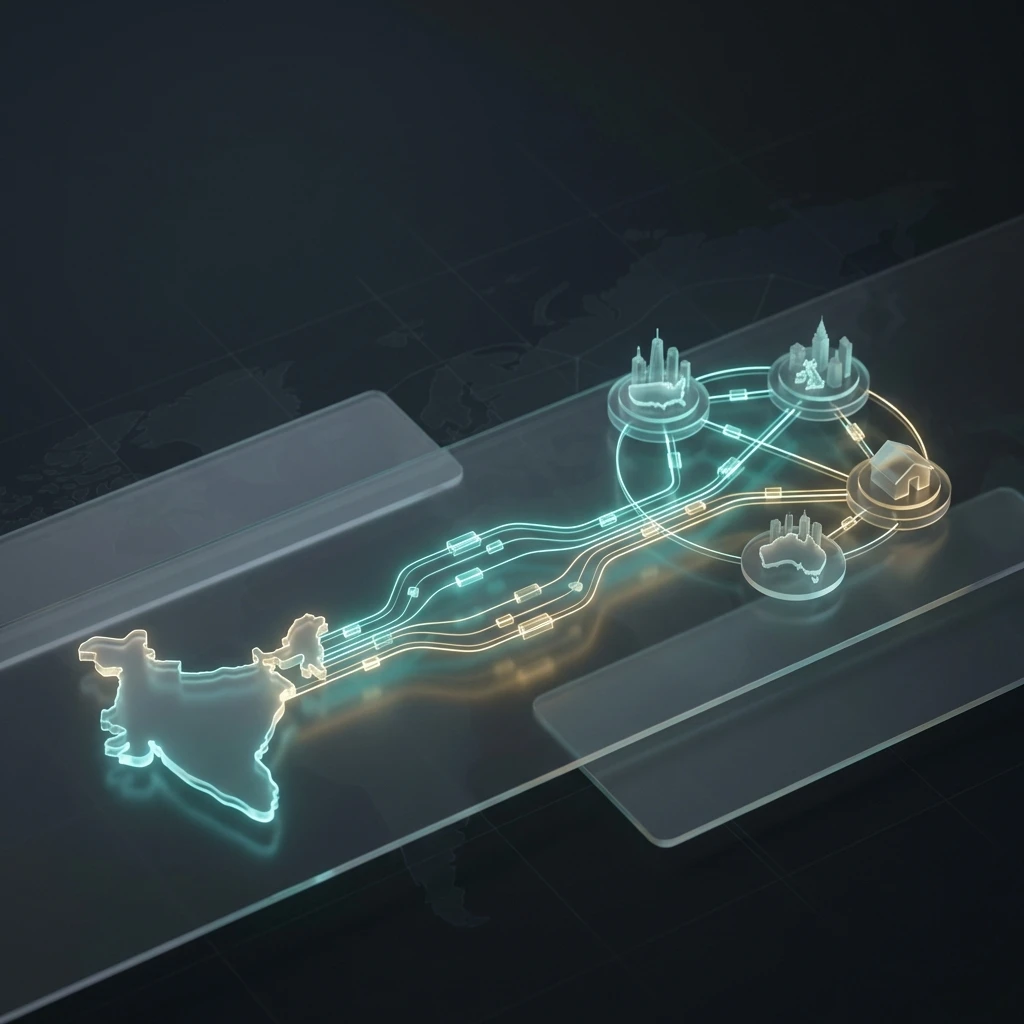

The Repatriation Process

Step 1: Deposit Sale Proceeds

Checks from the buyer must be deposited into your NRO Account. You cannot deposit INR sale proceeds directly into an NRE account.

Step 2: Pay the Taxes (TDS)

The buyer likely deducted roughly 20-23% TDS (Tax deducted at Source). Ensure they give you Form 16B. If your actual tax liability is lower (due to indexation), you file a tax return to get a refund.

Step 3: Get Form 15CB

Hire a CA to issue Form 15CB. They certify that money has been obtained legally and taxes have been cleared.

Step 4: Submit Form 15CA

Fill this out online on the Income Tax portal, referencing the 15CB certificate.

Step 5: Transfer to NRE/Foreign Account

Take these forms to your bank. They will convert the NRO balance to foreign currency and wire it to your overseas account.

Limits & Restrictions

- Cap: $1 Million USD per FY per individual. (Husband + Wife can do $2M).

- Source: Must be "Bonafide" income. Cash deals cannot be repatriated.

- Residential Properties: Restricted to repatriation of sale proceeds of not more than 2 residential properties acquired via foreign exchange. (Restriction relaxed for inherited properties).

Kanav Arora

Real Estate Investor

Read Next