Sindhudurg vs. North Goa: A Data-Driven Real Estate Comparison (2026)

For decades, "West Coast Real Estate" meant Goa. Period. But in 2026, the data tells a different story. The "Goa Premium" has become so high that it is eating into returns, while its neighbor, Sindhudurg (Vengurla/Kondura), is offering the same lifestyle at a fraction of the cost.

Let's look at the numbers.

1. The Entry Price (Capital Deployment)

This is the most glaring difference. In North Goa's established belts, land has become a scarce commodity for the ultra-wealthy.

| Market | Micro-Market | Approx Rate (Per Sqm) | What ₹1 Cr Buys |

|---|---|---|---|

| North Goa | Assagao / Vagator | ₹60,000 - ₹1,00,000+ | A small 150 sqm plot |

| Sindhudurg | Kondura / Vengurla | ~₹15,000 | A massive 650+ sqm estate |

Benchmark data based on projects like Mango Courtyard in Vengurla.

The Insight: In Vengurla, you aren't just buying land; you are buying space. For the same budget, you move from a cramped plot in Goa to a sprawling estate in Maharashtra.

2. Rental Yields (ROI)

Rental yield is a function of the numerator (Rent) and the denominator (Capital Cost). Goa has high rents, but the capital cost is astronomical. Sindhudurg has moderate rents, but the capital cost is rock bottom.

- Goa Scenario: Buy a villa for ₹6 Cr. Earn ₹20 Lakhs rent. Yield: ~3.3%.

- Vengurla Scenario: Buy land + build villa for ₹2.5 Cr. Earn ₹15 Lakhs rent. Yield: ~6%.

Because the entry in Vengurla is 85% lower, your path to positive cash flow is significantly shorter.

3. The Saturation Index

- Goa (2026): Traffic jams in December are legendary. Water shortages are common. The "peace" is often broken by construction noise next door.

- Sindhudurg (2026): Still retains the sleepy, village charm. Roads are empty. Beaches like Kondura have zero commercial shacks.

4. The "Mopa" Equalizer

The argument used to be "Goa is better connected." With Mopa Airport operational, that argument is dead.

- Assagao to Mopa: ~45 mins.

- Vengurla to Mopa: ~50 mins.

You access the exact same international connectivity corridor.

Conclusion

If you want status and don't mind overpaying, buy in Assagao. If you want ROI, space, and future appreciation, cross the border to Vengurla.

The smart money is using the Coastal Highway to drive 20 minutes north and save 80% on capital cost.

Kanav Arora

Real Estate Investor

Read Next

The "Golden Triangle" Report 2026: Assagao, Siolim, & Parra Price Analysis

Why Assagao is hitting ₹45,000/sqft while Parra offers a value entry. We decode the pricing and ROI of North Goa's most expensive corridor.

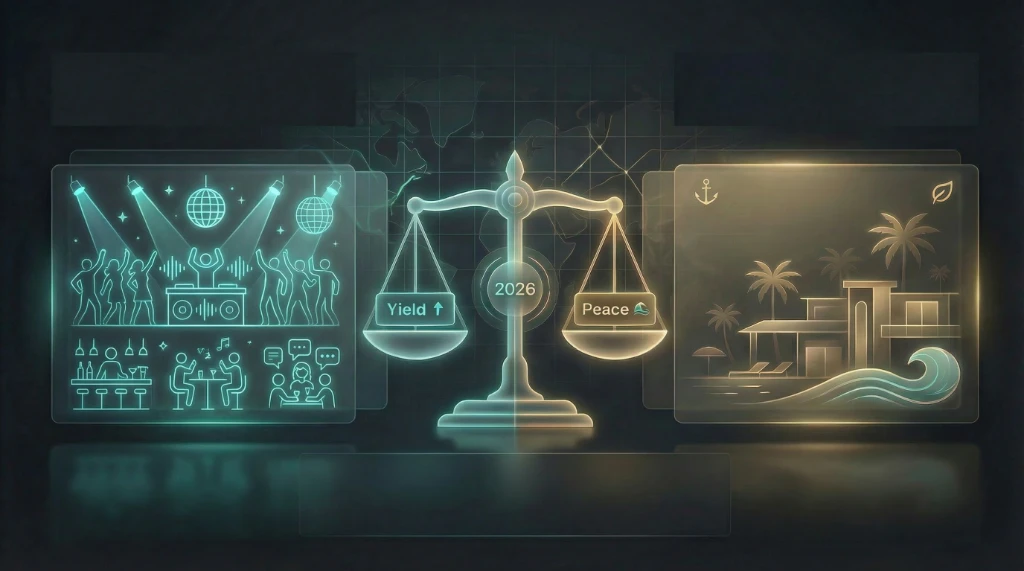

North vs. South Goa: The Investor’s Dilemma (Yield vs. Peace) - 2026 Edition

Buying in Assagao gives you 8% yield but 20% risk. Buying in South Goa gives you zero yield but 100% peace. We break down the 2026 investment thesis.