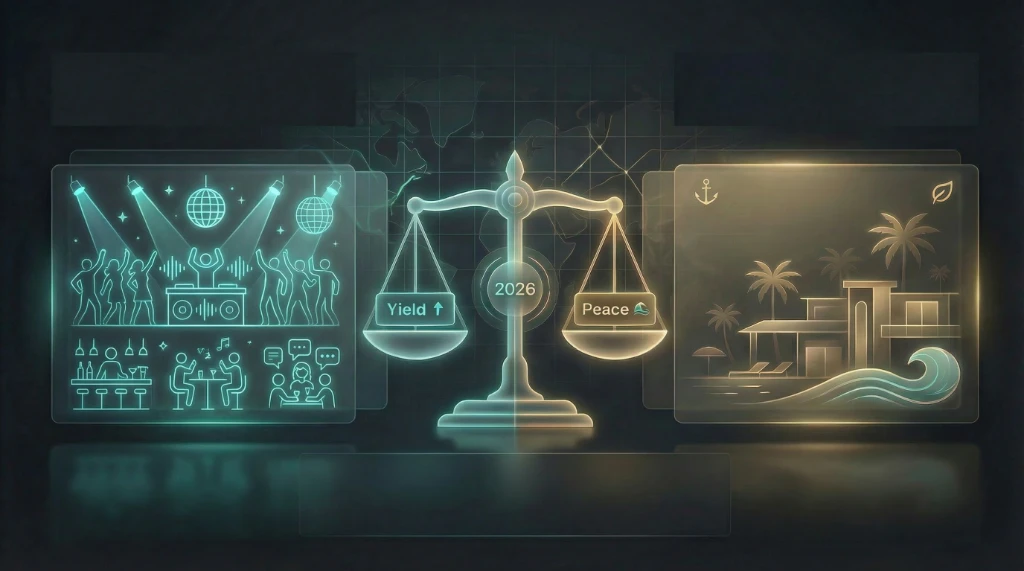

North vs. South Goa: The Investor’s Dilemma (Yield vs. Peace) - 2026 Edition

The most common mistake first-time Goa buyers make is asking: "Where should I buy?" The correct question is: "What am I buying FOR?"

In 2026, Goa is no longer one market. It is two completely different economic zones separated by the Zuari bridge.

- North Goa is a Hospitality Market (High Yield, High Noise).

- South Goa is a Residential Market (Low Yield, High Peace).

If you mix these up, you will either hate your home or hate your bank balance. Here is the asymmetric analysis to help you decide.

The North: The "Alpha" Market (Assagao, Vagator, Siolim)

The North is driven by one metric: Occupancy. With the new Mopa Airport fully operational, the "Golden Triangle" of Assagao-Siolim-Parra has become the most expensive real estate pin code in non-metro India.

- The Pros:

- Yields: 8% - 12% is real. A 4BHK villa here generates ₹60L - ₹80L revenue annually.

- Liquidity: You can sell a North Goa villa in weeks. The demand is insatiable.

- Appreciation: Prices are compounding at 15-20% annually.

- The Cons:

- The "Vibe" is Gone: It is crowded. Traffic is metro-level. If you want a quiet writer's retreat, this is not it.

- Oversupply Risk: Every builder is launching "Bali Villas". Differentiation is getting harder.

Deep Dive: Want to know which specific village offers the best ROI? Read our Golden Triangle Analysis: Assagao vs. Siolim vs. Parra.

The South: The "Endless" Market (Palolem, Benulim, Agonda)

South Goa is what North Goa used to be 15 years ago. The buyers here are not looking for Airbnb income. They are looking for Sanity.

- The Pros:

- Peace: You can still hear the ocean, not the trance music.

- Price: You get 2x the land for the same price as Assagao.

- Stability: Less prone to "bubble" busts because it's driven by end-users, not speculators.

- The Cons:

- Yields are low: Expect 3-4%. The "party crowd" doesn't come here, so occupancy is seasonal (Nov-Feb).

- Slower Appreciation: Keeps pace with inflation (6-8%), but won't make you rich overnight.

The "Third Option": Vengurla (The New North)

For 2026, a new contender has emerged. Just 20km north of the border, Vengurla (Sindhudurg) offers the topography of North Goa with the peace of South Goa—and a massive price arbitrage.

- Proximity: 50 mins from Mopa Airport (same as Assagao).

- Price: ~₹15k/sqm vs ₹1L/sqm.

- Vibe: Virgin beaches like Kondura.

If you find North Goa too saturated and South Goa too quiet, check out the Vengurla comparison.

The Verdict: The "Use-Case" Test

| If you want... | Buy in... | Because... |

|---|---|---|

| To cover your EMI via Rent | North Goa | Only high-occupancy zones can support Home Loan interests. |

| A Retirement Home | South Goa | You don't want drunk tourists next door at 3 AM. |

| Restoring an Old House | South/Inland | Portuguese homes need Settlement Plots, which are cheaper in the South. |

| Highest Capital Gains | North (Emerging) | Look at "border" villages like Thivim or Dodamarg (just north of Mopa). |

Goa Rental Yield Reality

High yields in North Goa come with high tax liability. Remember that rental income is taxable in India. Check our compliance checklist to see how to claim the 30% Standard Deduction and avoid paying tax on the gross amount.

Financial Reality: Before you pick a side, check the Hidden Costs of Buying in Goa. The registration fees are the same for North and South, but the "Lifestyle Tax" is very different.

Kanav Arora

Real Estate Investor

Read Next

Sindhudurg vs. North Goa: A Data-Driven Real Estate Comparison (2026)

The "Golden Triangle" Report 2026: Assagao, Siolim, & Parra Price Analysis

Why Assagao is hitting ₹45,000/sqft while Parra offers a value entry. We decode the pricing and ROI of North Goa's most expensive corridor.

Where to Invest Near Mopa: Top 5 Zones for High Rental Yields in 2026

Pernem is the new investment hotspot. We rank the top 5 zones based on rental yield, capital appreciation potential, and livability. Spoiler: The best spot isn't where you think.